Tax season is one of the most financially important periods of the year, and for millions of households, a tax refund is not just extra cash but essential support for bills, debt repayment, savings, or major purchases. As the 2026 filing season begins, taxpayers want clear answers about when refunds will arrive, how long processing takes, and what factors could delay payments. Understanding the timeline and rules now can help you file correctly, avoid mistakes, and receive your money as quickly as possible.

Overview of the 2026 Tax Refund Process

A tax refund is issued when you have paid more tax during the year than you actually owed. This often happens due to payroll deductions, advance payments, or eligible tax credits. After you file your return, it is reviewed, processed, and approved before any payment is released.

Most refunds are delivered electronically through direct deposit, which is faster and more secure than paper checks. Processing speed depends on how you file, whether your return is accurate, and if additional verification is required.

Key Filing Timeline for 2026

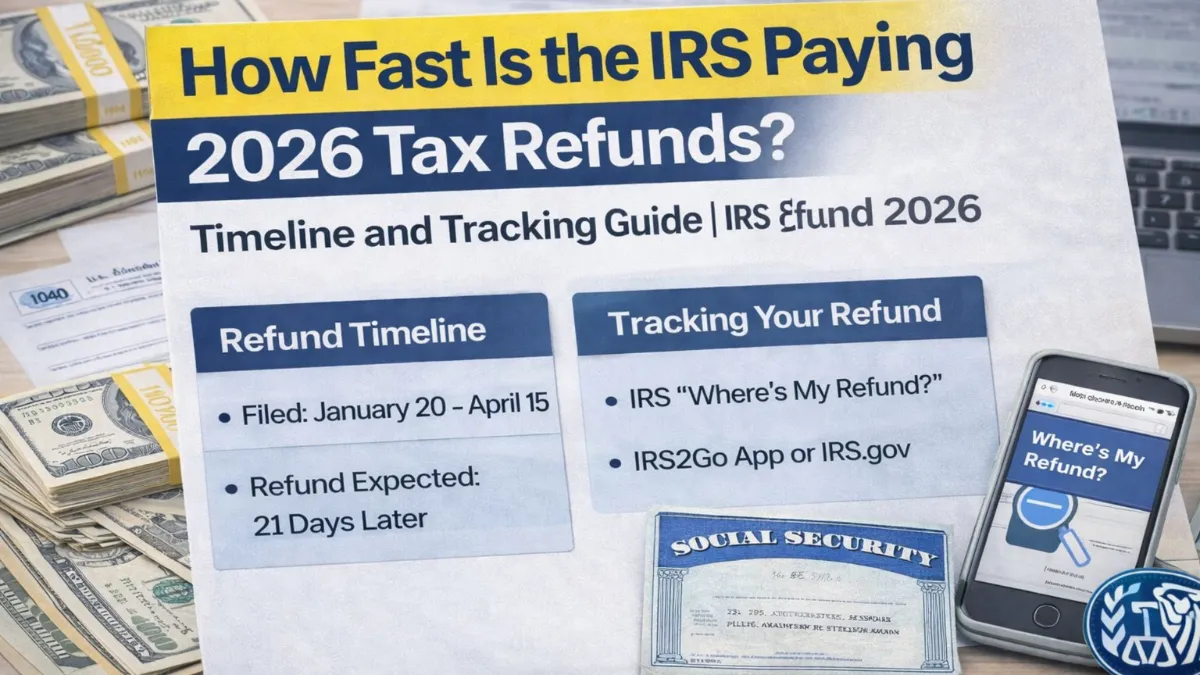

Tax authorities typically open filing season early in the year and continue accepting returns for several months. Filing early can reduce delays and identity fraud risks while helping you receive your refund sooner.

| Stage | Estimated Timeline | What Happens |

|---|---|---|

| Filing Opens | Early 2026 | Tax returns begin to be accepted |

| Peak Filing Period | Mid-season | High volume may slow processing |

| Standard Deadline | Spring 2026 | Last day for on-time filing |

| Refund Processing | Ongoing | Returns reviewed and approved |

| Late Filing Period | After deadline | Possible penalties or delays |

Exact dates vary each year, but most taxpayers who file early and electronically receive refunds within a few weeks.

Who Is Eligible for a Tax Refund

Not everyone who files taxes will receive a refund. Eligibility depends on how much tax you paid during the year compared to your final tax liability.

Refunds are more likely if you had significant payroll withholding, qualify for tax credits, or made estimated payments exceeding your obligation. Individuals with lower income levels, families with dependents, students, and retirees may qualify for various credits that increase refund amounts.

Self-employed individuals can also receive refunds if they overpaid estimated taxes.

Key Rules and Important Features

Understanding the rules can help avoid mistakes that slow down processing or reduce your refund.

Key highlights for the 2026 tax season include:

• Electronic filing is processed faster than paper returns

• Direct deposit is the quickest payment method

• Errors or missing documents can trigger manual review

• Tax credits may increase refund amounts significantly

• Outstanding debts may reduce or offset refunds

How Refund Processing Works

Once a return is submitted, it goes through several stages. Automated systems first check for errors, duplicate filings, or suspicious activity. If no issues are found, the refund is approved quickly.

Returns requiring manual review take longer. This may happen if income information does not match official records, identity verification is needed, or complex credits are claimed.

After approval, payment is released to your bank or mailed as a check. Banks may take additional time to post the deposit to your account.

Typical Processing Time for Refunds

Processing time varies widely based on filing method and accuracy.

Electronic returns with direct deposit are usually completed within about two to three weeks. Paper returns can take several weeks longer due to manual handling and mailing time.

Peak filing periods often slow processing because of the high volume of submissions.

Possible Delays and Challenges

Several factors can delay a refund even if you file on time. Mistakes on forms, incorrect bank details, missing signatures, or mismatched income records are common causes.

Identity theft protection measures may also hold refunds temporarily while additional verification is completed. Filing close to the deadline increases the chance of delays due to system congestion.

Refunds may also be reduced or withheld if you owe certain government debts or unpaid obligations.

How to File and Claim Your Refund

To receive a refund, you must file a tax return accurately and on time. Using reliable tax software or professional assistance can reduce errors and speed up approval.

Gather all necessary documents before filing, including income statements, deduction records, and identification details. Double-check bank information if choosing direct deposit.

After filing, keep confirmation records and monitor the status of your return until payment is received.

Latest Updates and What to Expect in 2026

The 2026 tax season is expected to follow standard procedures, with continued emphasis on electronic filing and fraud prevention. Authorities are increasingly using automated systems to detect errors and suspicious activity, which helps protect taxpayers but may lengthen processing for some returns.

Digital services and online tracking tools are becoming more common, allowing taxpayers to check refund status in real time.

Conclusion

Tax refunds in 2026 will be processed according to established timelines, with faster payments for those who file early, electronically, and accurately. Understanding eligibility rules, avoiding common mistakes, and choosing direct deposit can significantly reduce waiting time. Preparing documents in advance and monitoring your filing status will help ensure you receive your refund smoothly and without unnecessary delays.

Disclaimer

Refund timelines, rules, and eligibility may vary depending on individual circumstances and official policies. Always verify details through authorized sources.